“The lower fiscal deficit is certainly good news for the bond market with the cherry on top being gross borrowing way lower than the current year, paving the way for further lower drift in yields,”

By Ronojoy Mazumdar and Subhadip Sircar

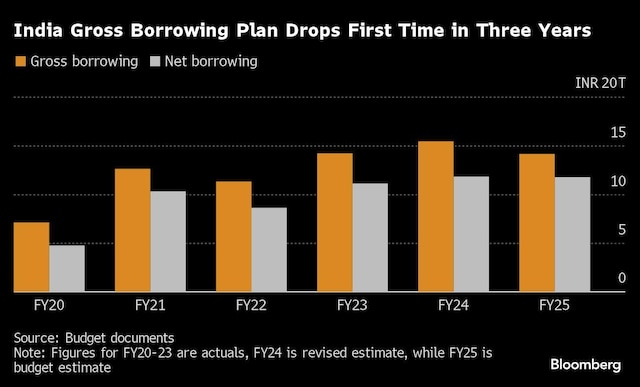

Indian bonds rallied, with the benchmark 10-year yield falling by the most in more than a year, after the government announced a lower-than-expected borrowing program for the first time in three years.

Prime Minister Narendra Modi’s administration plans to sell bonds worth Rs 14.13 trillion ($170 billion) in the fiscal year starting April 1, Finance Minister Nirmala Sitharaman said in her budget speech on Thursday. That’s lower than the Rs 15.2 trillion estimated in a Bloomberg survey.

Bonds also got a boost from a reduction in the government’s fiscal deficit target to 5.1 per cent of gross domestic product versus an estimate of 5.3 per cent in the survey. The rally extends the best January gain in five years for Indian sovereign bonds that was fueled by foreign inflows ahead of the global index inclusion from June.

The net borrowings, adjusted for maturities, are planned at Rs 11.75 trillion

for the next fiscal year. The yield on the benchmark 10-year bond fell as much as nine basis points to 7.05 per cent after the announcement.

Corporate bonds also rallied, with the average yield on top-rated three-year corporate bonds falling by 10-12 basis points, according to traders.

Foreigners have plowed more than 500 billion rupees into index-eligible debt since JPMorgan Chase & Co’s inclusion announcement in September. Still, foreigners own just 2 per cent of India’s sovereign debt market, leaving ample scope for new buyers.

“The lower borrowings by the central government will facilitate larger availability of credit for the private sector,” Sitharaman said in her speech.

First Published: Feb 01 2024 | 1:39 PM IST