Overseas demand will likely soak up about 8 per cent-9 per cent of the net supply, about twice as much as it did in the fiscal first half, the economists wrote | Representative image

By Subhadip Sircar and Cynthia Li

Global funds are snapping up India’s sovereign bonds ahead of the country’s addition to global debt indexes, and traders expect them to be a key pillar of demand for the near-record government borrowing in the coming fiscal year.

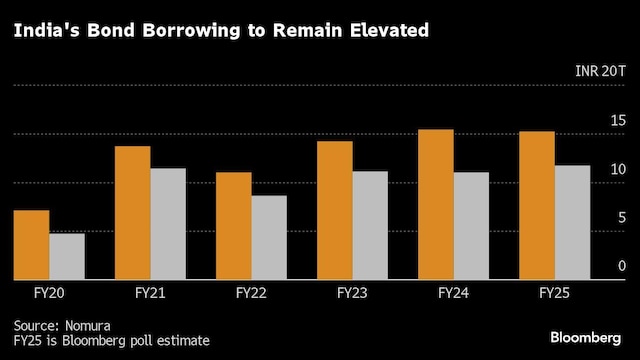

New Delhi will likely announce a gross borrowing of Rs 15.2 trillion ($183 billion) for the year starting April 1, marginally lower than the record Rs 15.43 trillion set for the current year, according to a median estimate in a Bloomberg poll of 21 economists.

Foreigners have plowed more than Rs 50,000 crore into index-eligible debt since JPMorgan Chase & Co’s September’s inclusion announcement. The nation’s bonds may lure $100 billion of inflows in the coming years, according to HSBC Asset Management, as one of the world’s fastest rates of economic growth lures investors.

“We expect foreign investor inflows of $20 billion to be a game-changer for FY25 demand dynamics,” Standard Chartered Plc. economists including Anubhuti Sahay wrote in a note. “While inflows are trickling in, we expect them to accelerate as actual inclusion starts in June.”

Overseas demand will likely soak up about 8 per cent-9 per cent of the net supply, about twice as much as it did in the fiscal first half, the economists wrote. Foreigners own just 2 per cent of India’s sovereign debt market, leaving ample scope for new buyers.

JPMorgan will add Indian government bonds to its benchmark emerging-market index from June. Bloomberg Index Services Ltd. has also sought investor feedback to add the debt to its EM bond index, effective September. Bloomberg LP is the parent company of Bloomberg Index Services, which administers indexes that compete with those from other providers.

RBI Stance

A favorable demand-supply backdrop for government debt will come as a breather given the Reserve Bank of India’s stance to keep interest rates high. Most economists expect the monetary authority to only begin lowering rates later in the year once it brings inflation down to its 4 per cent target.

Prime Minister Narendra Modi’s administration will present an interim budget on Feb. 1 ahead of a general election due by May. Economists expect the government to stay fiscally conservative, with Modi widely expected to win a third term. The fiscal deficit is seen narrowing to 5.4 per cent from an estimated 5.9 per cent in the current year, the Bloomberg survey showed.

Net borrowing, adjusted for repayment of bonds, is seen at Rs 11.7 trillion, according to the survey.

More Buyers

The growing footprint of longer-term investors like insurers and pension funds is also helping the government reduce its reliance on debt purchases by banks.

“This trend is likely to persist as the formal sector widens and a higher proportion of household financial savings is allocated toward insurance and long-term savings,” said Gaura Sen Gupta, an economist at IDFC FIRST Bank Ltd.

The interim budget will likely point to only a marginal increase in bond supply for the coming fiscal year, Citibank economists Samiran Chakraborty and Baqar Zaidi wrote in a note. Gross supply, including state borrowing, will likely be Rs 25.4 trillion, a marginal gain from the estimated Rs 24.7 trillion in the current year, Citi said.

“Together with the likely start of India’s gradual policy easing, we expect yields to eventually head lower,” the economist wrote in a note.

IDFC FIRST Bank said the benchmark 10-year yield may drop to 6.8 per cent in the coming fiscal year, while Trust Mutual Fund sees a good chance that it trades at 6.5 per cent by the end of 2024. It closed at 7.18 per cent on Wednesday.

The following table shows demand estimates by StanChart for federal and state debt combined from various investors with total supply seen at Rs 19.71 trillion.

First Published: Jan 25 2024 | 8:19 AM IST