Bhuta, a partner at P.R. Bhuta & Co., came across one such instance when he was advising one of his NRI clients from Singapore on Indian investments. Under the Double Taxation Avoidance Agreement (DTAA), non-resident Indians (NRIs) based in select countries such as Singapore, UAE and Mauritius don’t have to pay capital gains tax on Indian mutual funds (MF). For NRIs based in Singapore, there is a rider though—a prerequisite that they have to meet before they are eligible for the tax benefit.

Article 24 (1) of the India-Singapore DTAA, states that the capital gains needs to be repatriated to Singapore. Since MF capital gains have to be taxed in Singapore (and not in India), the treaty requires the proceeds to be sent there for taxation. And herein begins the confusion. Singapore does not levy any tax on capital gains. Thus, the DTAA rule that states that gains need to be taxed in Singapore might not be fulfilled and, hence, some financial experts are of the opinion that the gains might be taxable in India.

Another interpretation by other experts is that since India does not have taxation rights on capital gains in the first place under the treaty, the income tax department cannot ask NRIs based in Singapore to pay up taxes if such a situation arises. The capital gains tax, say these experts, was never treated as exempt from taxation in India.

To be sure, not all chartered accountants agree to the first interpretation. Ameet Patel, a chartered accountant and partner at Manohar Chowdhary and Associates, said that Article 24 (1) of Singapore-India DTAA refers to income earned outside Singapore that is taxable in that country if it is repatriated there. It does not cover any other income. Taxation of capital gains made in India is not dependent on its repatriation to Singapore. Therefore, there is no compulsion to repatriate capital gains back to Singapore.

Capital gains earned by a Singapore-based investor from Indian mutual funds is not subject to tax in India as per the treaty between India and Singapore. Article 24 (1) is irrelevant for capital gains on MFs, added Patel who is also a part of Quantum AMC’s board of trustees.

On the other hand, Parizad Sirwalla, national leader, global mobility services–tax, KPMG in India, said the chances of scrutiny by Indian tax authorities cannot be ruled out for any treaty exemptions. However, established judicial precedents support exemption based on a valid tax residency certificate (TRC), even if the income remains untaxed in Singapore as per Singapore domestic tax law.”

Also Read : 9 key investing lessons you can learn from the great Shelby Davis

What about shares?

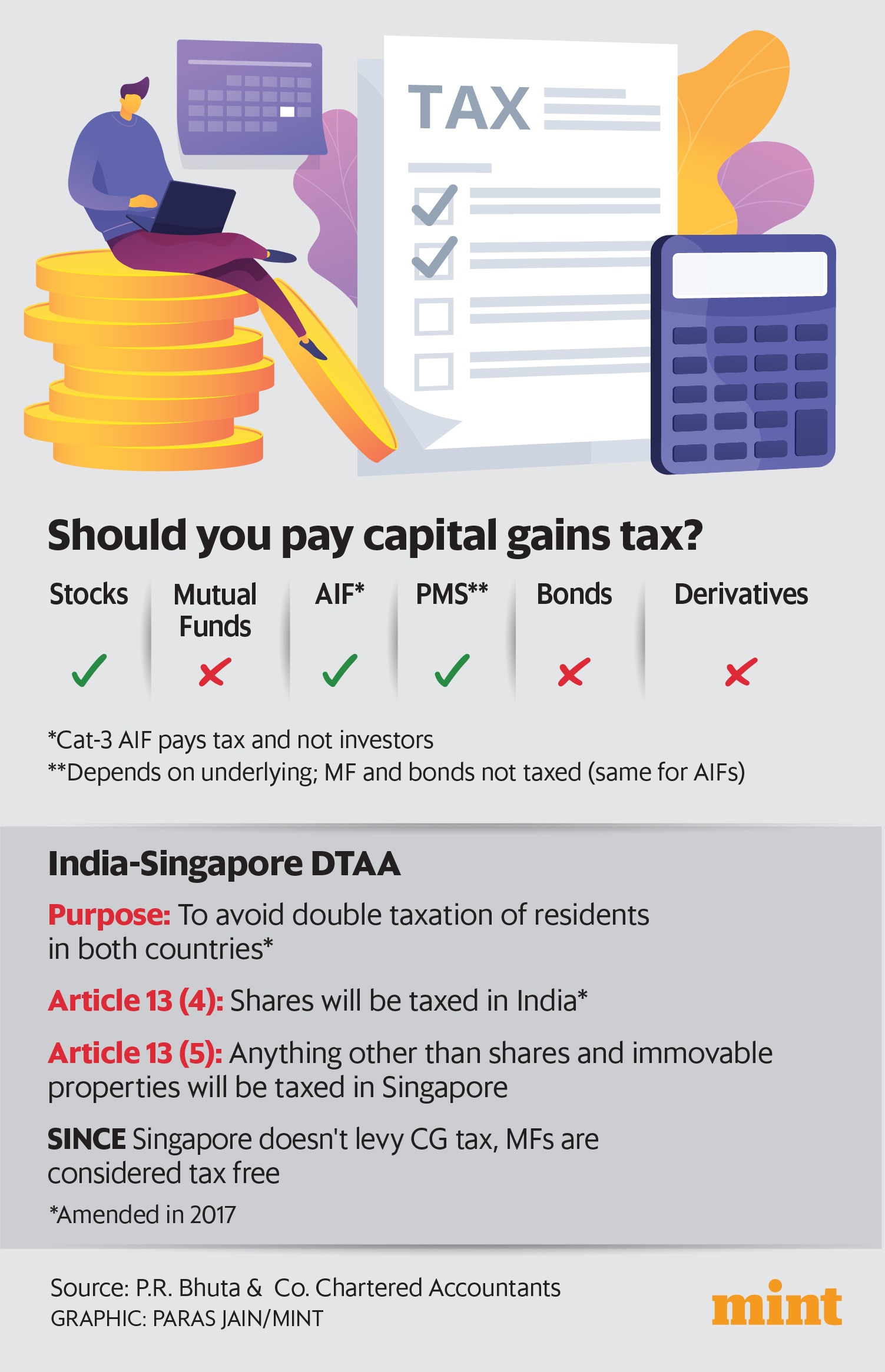

The benefit under the DTAA treaty which gives a tax free status to MF capital gains does not extend to stocks. The treaty was modified in 2017 to include tax on gains made from shares in the Indian jurisdiction. Till such time, shares also enjoyed tax-free status on capital gains. From April 2017 till March 2019, they were only taxed at 50% of the applicable rate in India.

While shares are taxed, Article 13 (5) said that all other assets other than shares and immovable properties will be taxed in the ‘contracting state of which the alienator is a resident’ (Singapore, in this case). Since Singapore does not levy tax on personal investments including capital gains, mutual funds and other securities are considered tax free. For that matter, bonds, convertible debentures, and futures and options (F&O) enjoy similar tax free status.

To get this benefit, NRIs need to fulfil the criteria of being a resident of Singapore as defined under the treaty. After that, they have to get a TRC from the Singapore government and then generate form 10F online from the Indian income tax portal.

These are the requirements to qualify for refunds under the India Singapore DTAA treaty. Only then can an NRI file for a refund of the capital gains tax deducted on MFs (and other such eligible securities).

For this, they need to furnish the TRC and form 10F. It is also possible to directly ask asset management companies (AMCs) not to deduct tax at source, but experts say it’s difficult to convince AMCs as they don’t want to be involved in such complicated arrangements.

If the claim is rejected by the tax department, one can file a revision petition, appeal before the Commissioner of Income Tax (A) or submit a rectification application.

Treaty shopping

Experts dealing with international taxation warn people against treaty shopping—the act of becoming a resident of a particular country for any short period with the sole purpose of getting tax benefits under the DTAA treaty. Such treaties have provisions to take note of treaty shopping. Bhuta says even if this provision does not apply, the General Anti-avoidance Rule (GARR) in India will thwart any bid at treaty shopping.

What you should do

To get the benefit of this treaty, the Singapore NRIs should invest in mutual funds as shares are taxed in India according to prevailing rates. In India, gains from shares held for more than a year are currently treated as long-term capital gains and taxed at 10% while those held for less than a year are treated as short term capital gains and taxed at a higher rate of 15%.

Note that portfolio management services (PMS) and alternative investment funds (AIFs) do not enjoy such benefits. PMS investments are bought under the holder’s brokerage account so if the PMS manager buys shares, they are taxed in India. If the underlying is mutual funds, then they’re not taxed. Category-1 and category-2 AIFs are also pass-through instruments and taxation depends on what the underlying investment is.

In the case of Category-3 AIFs, the AIF pays the tax on the scheme level and hence there is no treaty benefit for investors.