On 31 January, the Reserve Bank of India (RBI) placed operational restrictions on Paytm Payments Bank Ltd. (PPBL) due to ongoing non-compliance issues and significant supervisory concerns. The company’s stock price has corrected by 55 per cent on both NSE and BSE since 31 January till data.

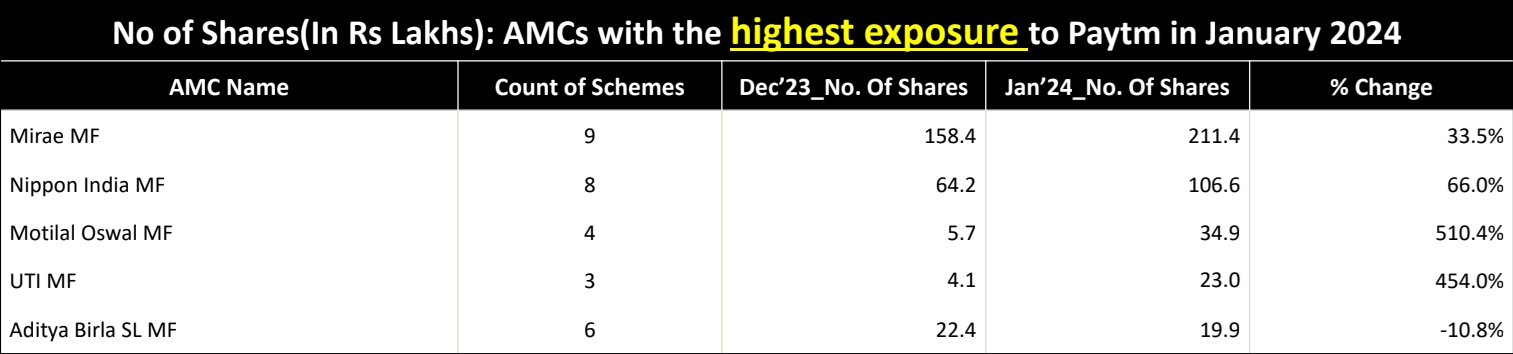

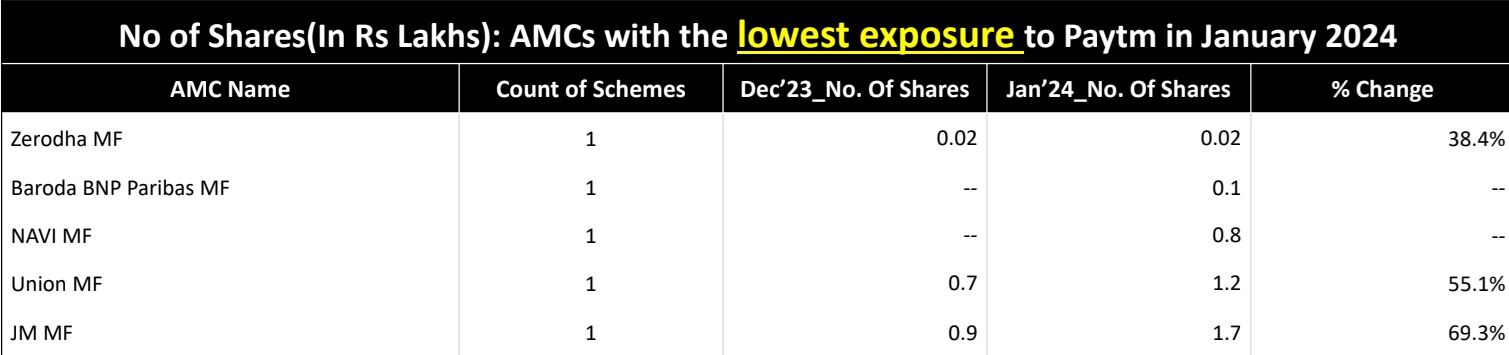

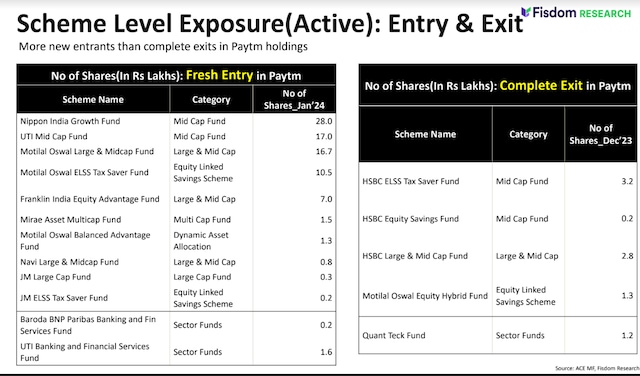

In terms of share count, Nippon Mutual Fund, Mirae Mutual Fund, and Motilal Oswal Mutual Fund rank as the top three, holding the largest number of Paytm shares in their portfolios as of January 2024. Two AMCs, Baroda BNP Paribas, and Navi MF were the new entrants in Paytm in Jan’24 through actively managed funds.

HSBC AMC completely exited from the stock in January 2024, from its actively managed funds. Quant Mutual Fund on the other hand reduced the exposure by 72.4% during the same period & and Aditya Birla Sunlife MF has reduced the exposure by 10%

SBI Mutual Fund, Edelweiss Mutual Fund, Kotak Mutual Fund, TATA Mutual Fund, ICICI Mutual Fund, Bandhan Mutual Fund, and Grow Mutual Fund were not actively exposed to Paytm.

The number of schemes in Paytm’s portfolio increased from 70 to 77 in January 2024.

The Mutual Fund Industry’s Rs. 3,384 Crore Exposure to Paytm

AMC Level: Increase and Decrease Trends

HSBC mutual fund fully exits; Quant mutual fund reduces Paytm holdings by 72%

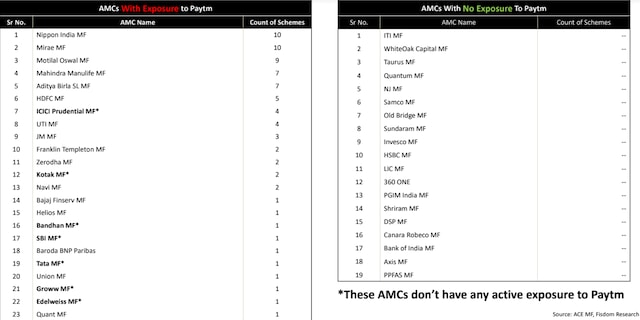

Scheme Level Exposure (Only Active)

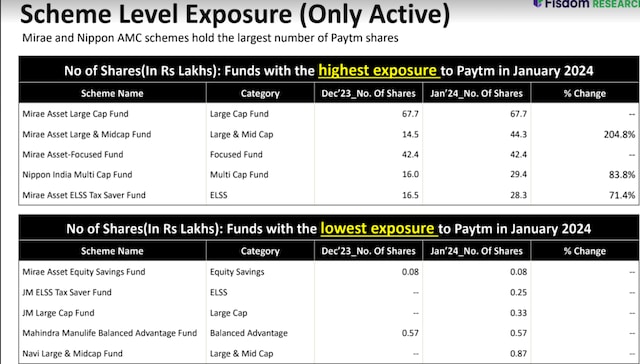

Scheme Level Exposure(Active): Entry & Exit

First Published: Feb 21 2024 | 10:01 AM IST